Flash News NA 18/07/2024

Additional payment per account

Portugal_ The payment of taxes is a duty that must be fulfilled by all taxpayers, whether business or individual.

In addition to being a tax obligation, taxes also represent a social responsibility that covers everyone, since it is through them that we can collaborate for the sustainability of the State and for the daily functioning of our society. In addition to Value Added Tax (VAT), there is Corporate Income Tax (CIT) for companies and Personal Income Tax (IRS) for citizens, especially self-employed workers. The Additional Payment by Account is inserted in the context of these taxes.

Entities required to make payments on account and additional payments on account shall make the additional payment on account in cases where state surcharge was due in the previous tax period in accordance with Article 87A https://diariodarepublica.pt/dr/legislacao-consolidada/lei/2014-64205634-114803067).

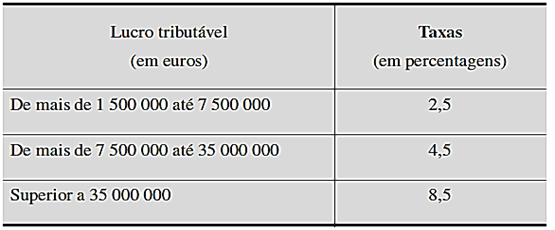

When calculating additional payments on account, the taxable profits of the previous fiscal year are taken into account, to which the rates laid down in Article 105a of the CIRC (https://diariodarepublica.pt/dr/legislato-consolidated/lei/2014-64205634-114803071) are applied for values above 1.500.000€.

The payment terms for Additional Payments per Account are the same as for Payment per Account.

1st Payment - July (or 7th month)

2nd Payment - September (or 9th month)

3rd Payment - until December 15 (or until the 15th of the 12th month)

Where the use of the special corporate tax regime is required, an additional payment is required on behalf of each of the group companies, including the dominant company.

While Additional Payments on Account may initially seem like yet another unwanted tax, they are a tool that enables your business to distribute the amount of a tax that would need to be paid anyway. Therefore, these payments help reduce the tax burden, dividing it into three distinct portions throughout the year.

At Nominaurea, we are available to support your company in all key issues to develop your activity always complying with all legal requirements. We are looking forward to your contact!